India’s credit card market has hit a milestone, with over 100 million active cards as of February 2024. Credit card spending reached a high of US$220 billion in FY24. The market has seen a 12% growth rate over the last four years.

This growth has taken the number of active cards from 57.7 million in FY20 to over 101 million in FY24. Despite this, credit card use is still low, at under 4%. This shows there’s a lot of room for growth.

The market is now seeing a slowdown in new card issuances and an increase in late payments. By June 2024, credit card balances had hit ₹3.3 lakh crore, a 26.5% jump from the previous year.

Key Takeaways

- The credit card market in India has surpassed 100 million active cards, with a CAGR of 12% over the last four years.

- Credit card penetration remains below 4%, indicating significant growth potential.

- The market is experiencing a slowdown in new card issuances and an increase in late payments.

- Credit card balances have reached ₹3.3 lakh crore, a 26.5% year-on-year increase.

- Co-branded credit cards are gaining market share, capturing 12-15% of the market by FY24.

Overview of India’s Credit Card Industry

The credit card industry in India has grown significantly in recent years. This growth is due to the middle class’s increasing wealth, more digital payments, and better banking services. By February 2024, there were over 10.1 crore active credit cards in India, showing a 12% growth rate over four years.

This growth is seen in the number of active credit cards. They went from 5.7 crores in FY20 to over 10.1 crores in FY24.

Current Market Size and Penetration

India’s credit card industry has seen significant growth, with over INR 18.26 lakh crore spent on credit cards in FY24. Yet only about 4% of people use credit cards, showing a lot of room for growth. The number of credit cards has doubled in five years and is expected to double again in the next five years.

The market could reach 20 crore cards by FY28-29, growing at a 15% CAGR.

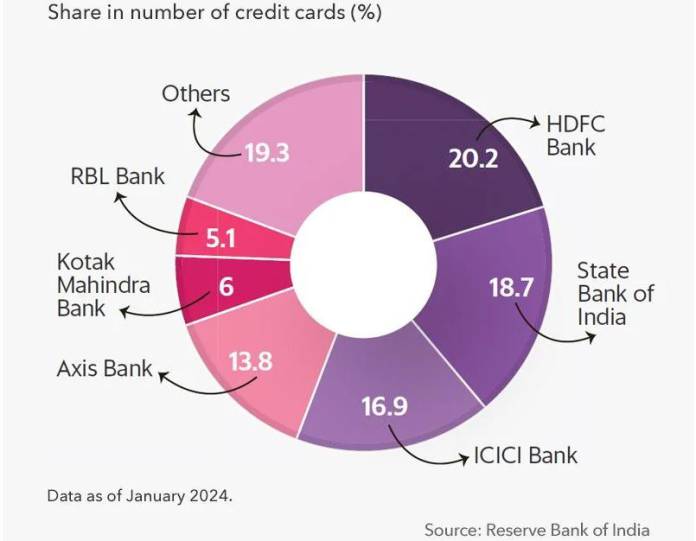

Key Players in the Indian Market

The big players in India’s credit card market are HDFC Bank, State Bank of India (SBI), ICICI Bank, and Axis Bank. These banks have 70.2% of all credit card balances and 74.5% of active cards. Medium-sized issuers have 17.9% of outstanding balances.

Market Growth Statistics

The Indian credit card industry has seen significant growth. Credit card transaction volumes have increased by 22%, and transaction values have increased by 28%. This is due to new products and more customers.

On the other hand, debit card use has dropped by 33%, with spending down by 18%. This is because of the Unified Payments Interface (UPI) rise.

India’s digital payments have also grown significantly. Transaction volume has increased by 42% year-over-year and is expected to triple by FY28-29, showing the country’s strong digital payments ecosystem.

Credit Card Market Growth Trajectory

India’s credit card market is changing fast. It’s moving from a luxury to a must-have item. By February 2024, over 10.1 crore cards were issued. But, new card issuances fell by 34.4% in Q1 FY25 compared to Q1 FY24.

Even with a slowdown, the credit card market in India still has a lot of room to grow. Only about 4% of people use credit cards, which shows great potential. Higher incomes, online shopping, and digital payments make credit cards more popular.

The credit card trends in India show the country’s shift to digital payments. In FY 2023–24, digital payments grew by 42%. UPI, a key player, made up over 80% of retail digital payments.

The credit card market in India will likely grow as digital payments improve. Credit cards are becoming easier to use with e-commerce and digital wallets, making them more appealing to more people.

Experts think India’s digital payments will grow a lot. They predict a threefold increase in transactions, from 159 billion in FY 2023-24 to 481 billion by FY 2028-29. The value of payments is also expected to double, from INR 265 trillion to INR 593 trillion.

As the credit card market in India changes, companies must keep up. They need to understand what customers want to take advantage of the opportunities ahead.

Leading Credit Card Issuers in India

The Indian credit card market is led by big banks like HDFC Bank, State Bank of India (SBI), ICICI Bank, and Axis Bank. These banks have a significant share, holding 70.2% of all credit card balances and 74.5% of active cards.

HDFC Bank’s Market Position

HDFC Bank is at the top with a 20% share, making it the biggest issuer in India. Its firm digital services and focus on high-limit cards have helped it stay on top.

SBI Card’s Performance

SBI Card, a part of State Bank of India, is second with a 19% share. But, it has faced some issues lately. It saw a 32.9% drop in net profit and increased costs.

Other Major Players

ICICI Bank and Axis Bank have 17% and 14% of the market, respectively. Newcomers like IndusInd Bank and Bank of Baroda are also growing fast. They saw 30% and 29% growth in credit cards.

| Bank | Market Share | Growth Rate |

|---|---|---|

| HDFC Bank | 20% | – |

| SBI Card | 19% | -32.9% |

| ICICI Bank | 17% | – |

| Axis Bank | 14% | – |

| IndusInd Bank | – | 30% |

| Bank of Baroda | – | 29% |

Digital Transformation in Payment Systems

The credit card market in India is changing fast. This is thanks to more people using digital payments and new technologies. Big banks like HDFC, ICICI, and Axis Bank are adding cool features. They offer digital credit cards and pay-later options to meet customers’ needs.

FinTech companies have changed how we pay in India. They make it easier and quicker to get a credit card through apps. The RBI’s move to link RuPay credit cards with UPI has made credit cards even more helpful.

- Cash in circulation in India increased by almost 8% in 2022–2023 compared to the previous year.

- Bank account ownership among Indian adults more than doubled between 2011 and 2017, from approximately 35% to 78%.

- UPI processed over $1 trillion in digital transactions in 2022, equivalent to a third of India’s GDP.

- In December 2023 alone, UPI recorded over 12 billion transactions.

- India has approximately 50 million merchants and 260 million distinct UPI users.

The credit card market in India is expected to grow fast, at a CAGR of 18% from 2022 to 2026. This growth is driven by the e-commerce market, which is set to reach $150 billion by 2026. Digital payments are key for smooth online shopping.

But, there are challenges. The rise in credit card and internet fraud cases is a big issue. Almost 50% of fraud cases were related to credit cards and the internet, according to the RBI’s 2022–2023 report. We need strong security and new ways to fight fraud.

“As the global payments market revenue is expected to grow from $2.85 trillion in 2024 to $4.78 trillion by 2029, India’s credit card market is poised to play a crucial role in this transformation.”

We need new technologies to overcome these challenges. Biometric authentication, mPOS systems, and AI for risk assessment are key. They will help drive digital change in India’s credit card industry.

Credit Card Revenue Models

The credit card industry in India has many ways to make money. This helps issuers stay profitable and offer good deals to customers. They mainly make money through interest, 40-50% of their earnings. Credit cards in India have annual interest rates between 18% and 42%.

Another big way they make money is through interchange fees. These fees are for processing transactions and makeup 20-25% of their income. They also make money from annual, over-limit, and late payment fees.

This mix of income helps credit card companies in India keep going and innovate. As the credit card fees world in India changes, they need to find a balance. They must make enough money while still giving good services to their customers.

“The credit card industry in India has experienced a 62% surge in the number of credit cards in circulation in three years, from 62 million in March 2021 to over 100 million.”

As the Indian credit card industry grows, issuers must change their strategies to stay ahead. Using different methods to make money, they can keep the industry strong and offer new and better credit card options for Indian consumers.

Credit Card Market in India: Current Trends

India’s credit card market is changing fast. Co-branded cards make up 12-15% of the market, up from 3-5% a few years ago. This growth comes from customized rewards, exclusive access, and special discounts that meet Indian consumers’ needs.

More people in India want co-branded cards, especially for travel, dining, online shopping, and groceries. These cards offer unique benefits and perks, which attract many customers and help the credit card market in India grow.

The Indian credit card industry is also moving online. New technology has made getting, using, and managing credit cards more straightforward and faster, making the whole process smoother and more efficient.

| Key Trend | Impact |

|---|---|

| Surge in Co-branded Cards | Increased from 3-5% in FY20 to 12-15% by FY24, driven by customized rewards and exclusive benefits |

| Digital Transformation | Improved customer experiences through enhanced onboarding, underwriting, and card processing |

| Technological Innovations | Advancements in areas like tokenization, AI, and ML for fraud detection and personalization |

| Specialized Credit Card Products | Tailored offerings for diverse consumer segments, such as Gen Z, affluent travelers, and eco-conscious customers |

The credit card trends in India are changing, and the market is expected to grow. This growth is thanks to the middle class’s increasing spending power, the tech-savvy younger generation, and the demand for financial solutions that fit different needs.

“The credit card industry in India is undergoing a digital transformation, with technology partners playing a pivotal role in enhancing the overall customer experience.”

Consumer Spending Patterns

India’s economy is shifting from saving to spending more. Credit card use in India grew by 27% in fiscal year 2024, reaching $219.21 billion. In March 2024, transactions jumped by 10.07% from last year, hitting $19.69 billion. This was due to year-end spending and festival sales.

Several factors have driven this growth. High discounts, attractive rewards, and flexible payment options like EMI and BNPL are key. These options encourage more spending online, where people can enjoy these benefits.

| Metric | March 2024 | February 2024 | YoY Change |

|---|---|---|---|

| Total Credit Card Transactions | $19.69 billion | $17.89 billion | 10.07% increase |

| Point-of-Sale (PoS) Transactions | $7.25 billion | $6.53 billion | 11.03% increase |

The data shows a bright future for India’s credit card sector. As spending habits change, the market is set to grow.

Credit Card Rewards and Benefits

The credit card market in India has grown a lot. Issuers now offer many rewards and benefits to keep customers. These programs help the industry grow by giving people good reasons to use their cards.

Loyalty Programs

Many credit card providers in India have loyalty programs. These programs give points, miles, or cashback for spending. They have tiered structures, offering more rewards for specific expenditures, like online shopping or dining.

Co-branded cards are also popular. They offer special rewards that match the partner brand’s services.

Cashback Offerings

Cashback is a favorite benefit in India. Some cards give up to 5% cashback on certain purchases, including online shopping, utility bills, and fuel expenses.

Redeeming cashback is easy, making it appealing. It helps offset regular spending.

Travel Benefits

Credit cards offer many perks to Indian travelers. These include free airport lounge access, discounts on flights and hotels, and travel insurance. These benefits meet the needs of those who travel often.

The variety of rewards and benefits in India has boosted the market. Credit cards are now more appealing to people of all incomes and spending habits. As the industry grows, these features will continue to shape the future of India’s credit card rewards and benefits.

Regulatory Framework and RBI Guidelines

The Reserve Bank of India (RBI) closely monitors the Indian credit card market. It ensures consumers are protected, and the market stays stable. Starting March 7, 2024, new RBI rules aim to make credit cards more transparent and used responsibly.

Important RBI rules for credit cards in India are:

- Card issuers need explicit consent from customers before giving out credit cards. The customer must destroy unsolicited cards.

- Business credit cards must follow the terms of the loan account. The principal account holder’s consent is needed for use.

- Late fees can only be charged after the due date. Issuers can’t charge interest or fees on unpaid taxes and levies.

- Cardholders can pick their billing cycle and change it through different channels.

- Explicit consent is needed to over-limit usage. The primary cardholder is responsible for dues, not add-on cardholders.

- Co-branding partners must follow RBI rules but can’t see card transaction data.

These rules help make the credit card regulations in India and RBI guidelines for credit cards more open and fair. They also help consumers make better choices.

The RBI has also allowed RuPay credit cards to link with the Unified Payments Interface (UPI). This makes credit cards more beneficial and helps more people in India. These steps show the RBI’s effort to improve the credit card market for everyone.

Market Challenges and Risk Factors

The credit card market in India is facing major challenges. These include rising default rates and increased competition from new payment methods like UPI, which threaten the industry’s growth and stability.

Default Rates Analysis

Late payments are increasing in all credit card categories in India. Cards with limits under ₹50,000 are at the highest risk. The percentage of overdue cards between 91 and 180 days has increased from 2.2% to 2.3% in a year.

For medium-sized card issuers, the percentage of cards overdue by more than 360 days has jumped from 1.5% to 3.8%. This shows a worrying trend in credit card default rates.

Competition from UPI

The Unified Payments Interface (UPI) is growing fast. It’s seen as a convenient and secure payment method, and this growth is challenging the expansion of the credit card market in India.

UPI’s popularity and acceptance among consumers and merchants threaten the growth of the credit card market.

| Metric | Value |

|---|---|

| Indian Equity Market Gains | 13 out of the last 15 years |

| Domestic Institutional Investment in the Past 4 Years | More than $100 billion |

| Brent Crude Oil Price | Above $77 a barrel, 3% decrease for the week |

| US Manufacturing Contraction | Fastest pace this year |

The credit card market in India is facing significant challenges. These include rising default rates and competition from new payment methods like UPI. These issues threaten the industry’s growth and stability. The industry needs to take proactive measures to address and mitigate these challenges.

Future Growth Projections

The credit card market in India is set for a bright future. Experts predict a big jump soon. Co-branded credit cards are expected to take over 25% of the market by 2028, growing fast at 35-40% annually. Traditional credit cards will grow slower, at 14-16% yearly.

The credit card market in India has a lot of room to grow. With only about 4% of people using credit cards now, there’s a lot of potential. Digital changes, better financial knowledge, and changing what people want will help the credit card market in India grow.

- Co-branded credit cards to capture over 25% of the market by volume by FY28

- Co-branded credit cards to grow at an annual rate of 35-40%

- Traditional credit cards to expand at a slower pace of 14-16% CAGR

- The current low penetration rate of under 4% indicates significant growth potential

- Factors driving future growth: digital transformation, increasing financial literacy, and evolving consumer preferences

“The credit card market in India is poised for exponential growth in the coming years, driven by the increasing adoption of digital payments and the rising financial awareness among consumers.”

As the credit card market in India grows, we’ll see new trends. Digital payments, more co-branded cards, and better financial access will shape the future. These changes will help the credit card market in India grow even more.

Impact of E-commerce on Card Usage

E-commerce in India has dramatically influenced credit card use. In January 2024, credit card spending hit US$20.41 billion, with e-commerce and bill payments accounting for over half of this amount. Sites like Amazon and Flipkart have made online shopping a regular activity for many, boosting credit card use.

Online Shopping Trends

In September 2024, Indians spent Rs 1,15,168 crore online using credit cards, 65.4% of the total Rs 1,76,201 crore spent. Online spending through credit cards grew from Rs 94,516 crore in April to Rs 1,15,168 crore in September, which shows an apparent rise in online shopping preference.

Digital Payment Integration

Companies like CRED have made it easier to use credit cards online, leading to more credit card use, especially among the young. A survey by Paisabazaar found that 80% of users saw more value in online shopping during festivals. 45% of them shopped online, while 45% did online and in-store.

| Metric | Value |

|---|---|

| Online credit card spending in September 2024 | Rs 1,15,168 crore |

| Total credit card spending in September 2024 | Rs 1,76,201 crore |

| Share of online credit card spends | 65.4% |

| The ratio of online to in-store credit card spends | 2:1 |

Thanks to e-commerce, credit cards have become more prevalent in India. Their convenience, security, and rewards make them a top choice for online shoppers, helping the country’s credit card market grow significantly.

Credit Card EMI and BNPL Services

India’s credit card market has grown significantly in recent years. This growth is thanks to Equid Monthly Installments (EMIs) and Buy Now, Pay Later (BNPL) services. These options let people buy and pay for big things in smaller monthly amounts.

Credit card EMIs are a big help. They offer credit at lower rates than usual, making it easier for Indians to buy electronics and travel with their credit cards.

BNPL services are also popular, especially among younger people. They let you buy things now and pay later without interest, making BNPL an excellent choice for those without credit cards.

| Feature | Credit Card EMI | BNPL |

|---|---|---|

| Interest Rates | Lower than standard credit card roll-over rates | Interest-free for a certain period |

| Eligibility | Dependent on credit card limit and approval | Flexible, often no credit checks required |

| Target Audience | Mainstream credit card users | Millennials and Gen-Z |

| Adoption | Widespread among credit card users | Rapidly growing, particularly in e-commerce |

Credit card EMIs and BNPL services have helped the credit card EMI India and BNPL India markets grow. They meet the changing financial needs and wants of Indian people.

“The credit card segment in India experienced a 30% year-on-year drop in originations in June 2024, contrasting with 8% growth in 2023, indicating a cautious stance adopted by lenders towards unsecured loans following RBI guidance.”

Geographic Distribution and Urban-Rural Divide

India’s credit card market shows a big difference between cities and rural areas. Most people use credit cards in big cities. This shows a gap in financial access and digital payments.

But things are changing. Banks are now focusing on smaller cities and rural areas. This urban-rural divide in credit card distribution in India is both a problem and a chance for the industry.

- Fast growth in cities and a rising middle class have boosted credit card use there.

- Rural areas have been slow to adopt credit cards. This is due to a lack of financial knowledge, poor digital setup, and limited banking access.

- Programs like PMGDISHA and PMJDY aim to close this urban-rural divide. They promote financial inclusion and digital skills in rural India.

The credit card market in India is set to grow significantly in rural areas. Better financial knowledge, improved digital setup, and more affordable financial services will help spread credit card distribution beyond cities.

“The credit card market in India has immense potential for growth, especially in the rural and semi-urban areas, as financial inclusion and digital adoption continue to improve.”

Technology Integration and Innovation

India’s credit card market is changing fast, thanks to new technologies. Now, people can get virtual credit cards right away through mobile apps. This digital onboarding makes it easy and quick to start using credit cards.

Contactless payments are becoming very popular in India. They offer both ease and safety for users. With almost 80% of digital payments now using UPI, more people choose this fast and secure option.

New Credit Cards as a Service (CCaaS) platforms are emerging. These platforms use advanced tech and APIs to make credit cards more personal and data-driven. These platforms have cool mobile apps, instant updates, and real-time reward tracking, aiming to keep users engaged and loyal.

- Fintech companies are leading the way in payment innovations. They’re making credit cards work with popular apps and offering digital-first options.

- New security features like biometric authentication and tokenization make transactions safer and more convenient.

- Data analytics and machine learning help create personalized rewards and offers based on how much you spend and what you like.

Credit card technology in India and the digital onboarding of credit cards are constantly improving. The Indian credit card market is set for even more changes. It will offer everyone a smooth, safe, and tailored payment experience.

Conclusion

India’s credit card market has grown significantly, with over 100 million active cards. This shows a significant change in the country’s financial scene. Despite issues like more defaults and competition from UPI, the market still has much room to grow.

Things like digital growth, more online shopping, and new card types are helping this growth. These factors are making the market more exciting and full of opportunities.

To keep growing, the market needs to balance expansion with careful lending. Credit card companies must listen to what customers want and improve their services. They should also use data to offer rewards that matter to people.

Using new tech like biometrics and AI to fight fraud is also key. This will increase customers’ trust in credit cards and keep the market strong.

The future looks bright for India’s credit card market. The growing middle class will keep driving demand. Credit card companies can thrive in India’s changing financial world by working together, improving their services, and teaching people more about money.