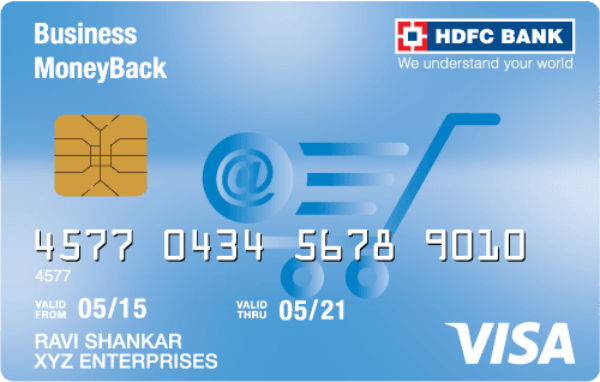

Reviews:

Here the Benefits and Advantages HDFC Moneyback Credit Card brings

Discounts for Foreign Currencies

When you need to spend in foreign currency, you will benefit from extra discounts and benefits with your HDFC Moneyback Credit Card. Thanks to the 2% + GST advantage, you will have a low foreign currency make up rate.

Lounge Access

You will have access to more than 700 lounges in your domestic and international travel experiences. Moreover, you will benefit from the advantages of a luxury service category. In this way, you will feel privileged.

Restaurant Discounts

The bank has agreements with more than a thousand restaurants in India. You can benefit from a 15 percent discount on all spending at these restaurants. To find out the names of the contracted banks, you should visit the official website of the bank.

Interest Free Loan Options

You will have the chance to benefit from interest-free loan options with a maturity of 50 days. A credit score is also required to take advantage of these options. Another opportunity is the charges on revolving credit, which has 1.99% + GST rates.

Reward Points at Renewal

You can earn 5,000 reward points when you renew your card usage annually.

Cashbak at Fuel Expenses

You will benefit from a 1 percent cashback opportunity until you reach the first 1000 Rs in your fuel expenses. This will save you 100 Rs on your first 1000 Rs.

Life Insurance

Life insurance is provided up to 2 Crores points. The life insurance service can be used as a result of accidents that occur while traveling on an airline. In addition, emergency health needs up to 50 lakhs are financed under the health insurance of HDFC Moneyback Credit Card.

Luggage Delays

There may be luggage delays sometimes on your travels. In such cases, travel insurance comes into play in order to meet your needs.

Redeem Your Points

You can freely redeem your points at more than 150 contracted airlines and buy discount air tickets.