Reviews:

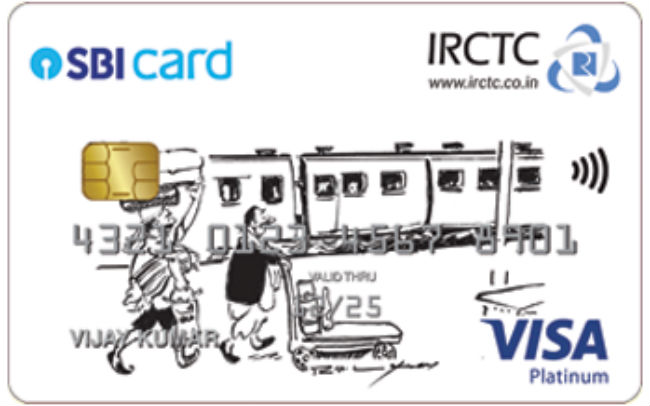

If you are looking for a great credit card that offers advantageous promotions and cashback in your railway bookings, then the IRCTC SBI Platinum credit card may be the ideal choice for you. This card is offered with the collaboration of IRCTC and SBI. In addition to its advantages in railway booking, it also offers promotions for fuel purchases. The advantages of the card are not limited to these; you can also benefit from special discounts on various Airline companies with this card! If you have to travel a lot, then you may want this card a lot too.

Advantages of IRCTC SBI Platinum Card

ATM Withdrawal Bonus

You can earn 100 Rupees cashback in your first ATM withdrawal within the 30 days after the IRCTC SBI Platinum credit card activation.

IRCTC Travel Promotions

You will receive a 1.8% discount on all bookings on irctc.co.in. Moreover, you can benefit from special discounts on different airline companies.

Free Add-on Cards

You can apply for add-on cards for your family members without the need for paying any extra charge or annual fee for them.

Fuel Surcharge Waiver

You can benefit from a 1% fuel surcharge waiver for all of your fuel spendings in any station in India.

Disadvantages of IRCTC SBI Platinum Card

Annual Fee

Just like most of the cards, the IRCTC SBI Platinum credit card has an annual fee too. This fee is 500 Rupees for the first year and you will need to pay 300 Rupees annually in the following years.

Limited Promotions

Although the card offers plenty of promotions, they are limited to travel, accommodation, and entertainment.

No Lounge

Despite it is a very beneficial credit card in terms of transportation, unfortunately, the card does not provide any privilege in domestic and international lounges in India.