Choosing the right credit card can be challenging, especially with many options. HDFC credit cards in India are very popular for good reasons. They offer excellent services, rewards, and special offers for different needs. We’ll look at the top HDFC credit cards for 2025, like the HDFC Diners Club Privilege Credit Card, HDFC Regalia Credit Card, and HDFC Infinia Credit Card. This will help you choose wisely.

We aim to give you a detailed review and comparison of HDFC credit cards for 2025. We’ll cover their main features, benefits, and what you need to qualify. We’ll also talk about special offers that can make your experience better. Whether you want travel rewards, lifestyle perks, or cashback, we’ll guide you to the best HDFC credit cards for 2025.

Introduction to HDFC Credit Cards

We’ll explore the different types of HDFC credit cards, such as premium, travel, and lifestyle cards. We’ll discuss their features, benefits, and the best options for 2025. We’ll also examine special offers and the top HDFC credit cards for 2025. This will help you choose the perfect card.

Key Takeaways

- Explore the best HDFC credit cards for 2025, including premium, travel, and lifestyle cards.

- Understand the key features and benefits of top hdfc credit cards 2025, such as rewards, cashback, and travel benefits.

- Discover the hdfc credit card offers 2025 that can enhance your overall experience.

- Learn about the eligibility criteria and application process for HDFC credit cards.

- Compare the top HDFC credit cards in 2025 to find the perfect card for your needs.

- Get insights into the best hdfc credit cards 2025, including the HDFC Diners Club Privilege Credit Card, HDFC Regalia Credit Card, and HDFC Infinia Credit Card.

- Make an informed decision with our comprehensive review and comparison of HDFC credit cards.

Understanding HDFC Credit Card Portfolio in 2025

To compare HDFC credit cards in 2025, it’s key to know how HDFC credit cards have evolved. They now offer many benefits like rewards, cashback, and travel perks. This variety caters to different customer needs.

Reading hdfc credit card reviews 2025 shows HDFC cards meet today’s consumer demands. They come with special rewards, discounts, and privileges. This makes them a favorite among Indians.

Evolution of HDFC Credit Cards

HDFC credit cards have changed a lot since they started. They focus on innovation and making customers happy. HDFC now has many credit cards, each with unique features and benefits.

Key Features Overview

Some prominent features of HDFC credit cards include:

- Reward points on everyday purchases

- Cashback on specific categories, such as fuel or groceries

- Travel benefits, including airport lounge access and travel insurance

- Exclusive discounts and privileges at partner merchants

Target Customer Segments

HDFC credit cards are for different types of customers. This includes those who value premium, travel, and lifestyle benefits. Customers can compare hdfc credit cards 2025 and pick the best one by knowing who they’re for.

Premium Category: HDFC Infinia Credit Card Analysis

The HDFC Infinia Credit Card is a top-tier card. It offers unlimited lounge access, golf privileges, and high reward points. To get this card, you need to meet certain hdfc credit card eligibility 2025 standards. These include income and credit score requirements.

Some of the key benefits of the HDFC Infinia Credit Card include:

- Unlimited lounge access at domestic and international airports

- Golf privileges at select golf courses in India and abroad

- High reward points earning potential on everyday spend

The HDFC Infinia Credit Card also offers excellent hdfc credit card rewards 2025. You can earn reward points, gift vouchers, and travel privileges. To apply, you must meet the hdfc credit card eligibility 2025 criteria. This includes a minimum income and a good credit score.

The HDFC Infinia Credit Card is perfect for those seeking premium benefits. Its unlimited lounge access, golf privileges, and high reward points make it ideal for discerning cardholders.

HDFC Diners Club Series: Black and Privilege Compared

The HDFC Diners Club series has two top credit cards: the HDFC Diners Club Black and the HDFC Diners Club Privilege. Both cards offer unique benefits and rewards. In 2025, hdfc credit card offers are better than before, so it’s key to compare them to find the best fit for you.

The HDFC Diners Club Black card has a high-end rewards program, while the HDFC Diners Club Privilege card offers travel insurance and concierge services. To choose the right card, consider your spending habits and what you value most.

Diners Club Black Features

The HDFC Diners Club Black card rewards up to 5x points on international purchases. It’s perfect for frequent travelers. The card also offers free access to airport lounges and special dining perks.

Privilege Card Benefits

The HDFC Diners Club Privilege card has a wide range of benefits, including travel insurance, concierge services, and shopping discounts. It also allows you to earn up to 3x points on online purchases, which is great for online shoppers.

Reward Structure Comparison

Looking at rewards, the HDFC Diners Club Black card gives more points for international buys. The HDFC Diners Club Privilege card offers more online transaction benefits. Your choice depends on how you spend and what you value most. With the latest hdfc credit card offers 2025, you can get even more rewards and perks.

| Card | Reward Points | Benefits |

|---|---|---|

| HDFC Diners Club Black | Up to 5x on international transactions | Complimentary airport lounge access, dining benefits |

| HDFC Diners Club Privilege | Up to 3x on online transactions | Travel insurance, concierge services, shopping discounts |

Travel Rewards: 6E Rewards XL Indigo HDFC Credit Card

The 6E Rewards XL Indigo HDFC Credit Card is perfect for those who travel a lot. It comes with many travel benefits and rewards. You can earn more points on Indigo flights, which can be used for free tickets and other travel perks.

This card offers travel insurance and help services, which is excellent for frequent travelers. HDFC credit card reviews 2025 show it’s a top choice for travel lovers. It’s packed with benefits and rewards, making it a must-have for any traveler.

There are many benefits to HDFC Credit Cards 2025, and this card is no different. It’s designed for those who want to get the most out of their travels. Key features include:

- Earn accelerated reward points on Indigo flights

- Redeem points for free tickets and other travel perks

- Enjoy travel insurance and assistance services

The 6E Rewards XL Indigo HDFC Credit Card is ideal for anyone seeking a travel-focused credit card. Its points earning and travel insurance make it a valuable asset for any traveler.

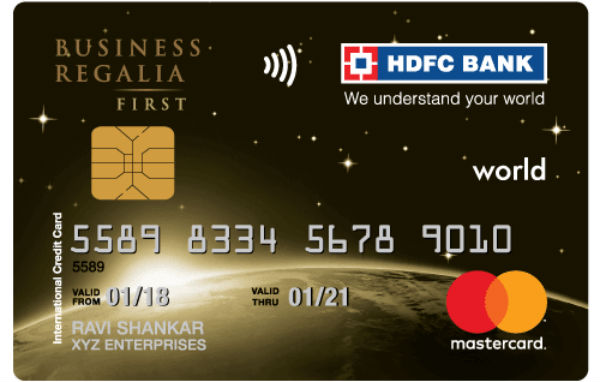

HDFC Regalia Series: Gold vs Regular

The HDFC Regalia credit card series has two types: Regalia Gold and Regular. Both are favorites among users, but they differ in key features. To pick the right one, look at its reward points, travel perks, and annual fees.

Reward Points Structure

The HDFC Regalia Gold card gives more points, especially in specific categories. On the other hand, the Regular Regalia card offers steady points across all categories.

Travel Benefits Comparison

Both cards have great travel perks, like lounge access and insurance. But, the Regalia Gold card adds extra benefits, like airport lounge access and more insurance.

Annual Fee Analysis

The Regalia Gold card costs more each year than the Regular Regalia card. To see which is worth it, think about the hdfc credit card eligibility 2025 and what each card offers. Both the hdfc regalia credit card and hdfc regalia gold credit card are popular, but the best choice depends on your needs.

Choosing between the HDFC Regalia Gold and Regular cards depends on your lifestyle and spending. You can pick the card that best suits you by examining points, travel perks, and fees.

Lifestyle Benefits: HDFC Millennia Credit Card Features

The HDFC Millennia Credit Card is made for those who love to live life to the fullest. It offers many perks that make everyday life better. With this card, you get cashback on online purchases, no extra fuel fees, and special discounts on lifestyle items.

Some of the key lifestyle benefits of the HDFC Millennia Credit Card include:

- Cashback on online transactions, making it an ideal choice for frequent online shoppers

- Fuel surcharge waivers, providing savings on fuel purchases

- Exclusive discounts on lifestyle purchases, such as dining, entertainment, and travel

The hdfc credit card rewards 2025 program gives points for every purchase. These points can be used for cool rewards. The hdfc credit card offers 2025 also have special deals and discounts. This makes the card perfect for those who want a card that fits their lifestyle.

The HDFC Millennia Credit Card is perfect for those who love lifestyle perks and rewards. Its unique features make it a top choice for anyone looking to get the most from their credit card.

Best HDFC Credit Cards for 2025: Top Picks by Category

Choosing the best HDFC credit cards for 2025 can be tricky. We’ve looked at hdfc credit card reviews 2025 to find the top picks. These are in three categories: travel, shopping, and rewards.

HDFC credit cards for 2025 come with great benefits. You can get exclusive rewards, cashback, and travel insurance. We’ve made a list to help you pick the best one.

Best for Travel

Travel enthusiasts will love the best hdfc credit cards for 2025. They offer travel insurance, airport lounge access, and rewards for travel bookings.

Best for Shopping

For those who love to shop, the best hdfc credit cards for 2025 are perfect. They give cashback, discounts, and rewards on shopping.

Best for Rewards

These cards are great if you want to earn rewards on your daily purchases. They offer high reward points and easy redemption options.

You can find the perfect match by looking at the benefits of the best hdfc credit cards for 2025. Choose one that fits your lifestyle and spending habits.

| Category | Best HDFC Credit Card | Benefits |

|---|---|---|

| Travel | HDFC Regalia Credit Card | Travel insurance, airport lounge access |

| Shopping | HDFC MoneyBack Credit Card | Cashback, discounts |

| Rewards | HDFC Rewards Credit Card | High reward points earning potential |

HDFC MoneyBack+ Credit Card: Cashback Analysis

The HDFC MoneyBack+ Credit Card is a favorite among many. It comes with lots of perks and rewards. With the hdfc credit card offers 2025, you can get cashback on what you buy. This makes it an excellent pick for those wanting to earn rewards on their everyday spending.

Some of the key features of the HDFC MoneyBack+ Credit Card include:

- Up to 5% cashback on online purchases

- 1% fuel surcharge waiver

- Exclusive discounts on dining and entertainment

The HDFC MoneyBack+ Credit Card also has a good rewards program. You can earn points for cashback, gift vouchers, or travel. Plus, you get hdfc moneyback+ credit card benefits like insurance and concierge services.

The HDFC MoneyBack+ Credit Card is perfect for those seeking a cashback card. It offers excellent benefits and rewards. Its competitive hdfc credit card offers 2025 and rewards, making it a top choice in India.

| Feature | Benefit |

|---|---|

| Cashback | Up to 5% on online purchases |

| Fuel Surcharge Waiver | 1% waiver on fuel purchases |

| Insurance Coverage | Exclusive insurance coverage for cardholders |

Unique Purpose Cards: IRCTC HDFC Bank Credit Card

The IRCTC HDFC Bank Credit Card is designed for train travelers. It offers special perks like transaction waivers and rewards for booking tickets online.

Railway Booking Benefits

This card has excellent benefits for booking train tickets. Users get rewards and discounts, which is perfect for regular train travelers. Some benefits include:

- Transaction waivers on railway bookings

- Rewards points on every booking

- Discounts on ticket fares

Additional Perks

The IRCTC HDFC Bank Credit Card also comes with extra perks, including travel insurance and help services. These features add to the card’s value, making it a great travel companion.

With the hdfc credit card offers 2025, users get even more benefits. These include special discounts and rewards. The benefits of hdfc credit cards 2025 are many, and this card shows how they can meet specific needs.

IndianOil HDFC Credit Card: Fuel Benefits

The IndianOil HDFC Credit Card is perfect for those who buy a lot of fuel. It offers many benefits that make it a great choice. With the Indian Oil HDFC credit card, you get to save on fuel and earn rewards on your purchases.

Some of the key benefits of the IndianOil HDFC Credit Card include:

- Fuel surcharge waivers on India fuel purchases

- Rewards on fuel purchases, which can be redeemed for cash back or other rewards

- hdfc credit card rewards 2025 program, which offers points or cashback on everyday purchases

To get the IndianOil HDFC Credit Card, you must meet specific criteria. You must have a good credit score and a steady income. This card is ideal for saving on fuel and earning rewards daily.

HDFC Intermiles Signature Credit Card: Miles and More

The HDFC Intermiles Signature Credit Card is a top pick for travelers. It comes with many benefits and rewards. You can earn miles on purchases with the HDFC Intermingles signature credit card. These miles can be used for flights, hotel stays, and more.

Air Miles Program

The HDFC Intermiles Signature Credit Card’s air miles program lets you earn miles on your purchases. These miles never expire. You can use them for flights, hotel stays, and other travel needs, making it perfect for those who travel often.

- Earning miles on purchases

- There is no expiration date for miles

- Redeeming miles for flights, hotel stays, and other travel expenses

Travel Insurance Coverage

The HDFC Intermiles Signature Credit Card also offers travel insurance. This insurance protects against unexpected trip cancellations, delays, and interruptions. The coverage includes:

| Benefit | Coverage |

|---|---|

| Trip Cancellation | Up to Rs. 1 lakh |

| Trip Delay | Up to Rs. 50,000 |

| Trip Interruption | Up to Rs. 1 lakh |

The HDFC credit card offers 2025, and the benefits of HDFC credit cards 2025 make the HDFC Intermiles Signature Credit Card ideal. It’s perfect for those seeking a credit card with travel benefits and rewards.

Credit Score Requirements and Eligibility Criteria

To get an HDFC credit card, you need to meet some requirements. The hdfc credit card eligibility 2025 includes a good credit score, a steady income, and a solid credit history. A high credit score can get you the best hdfc credit cards for 2025. These cards come with many benefits and rewards.

The hdfc credit card offers 2025 are made for different needs. To qualify for these offers, you must:

- Have a minimum credit score of 700

- Make at least ₹25,000 a month

- Have a good credit history with no defaults or late payments

- Be between 21 and 60 years old

Meeting these criteria can help you get the best HDFC credit cards. These cards offer rewards, cashback, and more. Always check your credit score and eligibility before applying for an HDFC credit card.

Annual fees Comparison

When picking the best hdfc credit cards for 2025, look at the annual fees and charges. hdfc credit card offers 2025 have different fees. Some cards waive fees or offer discounts. It’s key to compare these fees to make wise decisions.

Reviews of hdfc credit cards for 2025 show that some cards with higher fees offer more rewards. For example, the HDFC Infinia Credit Card has a higher cost but gives exclusive rewards and travel perks. With a lower fee, the HDFC MoneyBack+ Credit Card gives cashback on daily purchases.

The table below compares the annual fees of some popular HDFC credit cards:

| Card Name | Annual Fee | Renewal Fee |

|---|---|---|

| HDFC Infinia Credit Card | ₹10,000 | ₹10,000 |

| HDFC MoneyBack+ Credit Card | ₹500 | ₹500 |

| HDFC Regalia Credit Card | ₹2,500 | ₹2,500 |

By comparing the fees of different HDFC credit cards, you can choose the one that best suits your needs and budget.

Digital Features and Smart Banking Integration

HDFC credit cards come with cool digital features and smart banking integration. This makes it easy for users to manage their accounts and access services. With hdfc credit card offers 2025, you get online account management, mobile banking apps, and more. These tools make using your card a breeze.

Here are some key digital features of HDFC credit cards:

- Online account management: You can check your statements, pay bills, and transfer money online.

- Mobile banking apps: HDFC has apps for Android and iOS. This lets you manage your account anywhere.

- Digital payment options: You can use Apple Pay, Google Pay, and Samsung Pay with HDFC credit cards.

When picking the best hdfc credit cards for 2025, look at the digital features and smart banking. Hdfc Credit Card Reviews 2025 can give you the lowdown on what to expect. This helps you make a smart choice.

In short, HDFC credit cards have many digital features and innovative banking. This makes managing your account and using services easy. You can pick the best one for you by looking at what each card offers. Enjoy a convenient and safe banking experience.

| Card | Digital Features | Smart Banking Integration |

|---|---|---|

| HDFC Infinia Credit Card | Online account management, mobile banking app | Digital payment options, transaction alerts |

| HDFC Diners Club Credit Card | Online account management, mobile banking app | Digital payment options, rewards program |

Welcome Bonuses and First-Year Benefits

When it comes to hdfc credit card offers 2025, welcome bonuses and first-year benefits are key. The best hdfc credit cards for 2025 offer sign-up rewards like bonus points, cashback, and discounts on purchases.

Some of the key benefits of hdfc credit card rewards 2025 include:

- Sign-up rewards, such as bonus points or cashback on initial purchases

- Milestone benefits, awarded for achieving specific spending targets or anniversaries

- Discounts on purchases, such as fuel, dining, or travel

These benefits add value and encourage regular use of the credit card. By choosing the right hdfc credit card, customers can maximize their rewards. This makes the most of their Hdfc credit card offers in 2025.

Sign-up Rewards

Sign-up rewards are a key part of HDFC credit card offers in 2025. They give customers an incentive to apply for a new credit card. These rewards can be bonus points, cashback, or discounts on purchases.

Milestone Benefits

Milestone benefits are offered to customers who hit specific spending targets or anniversaries. They offer more rewards and benefits, such as bonus points, cashback, or exclusive discounts.

| Credit Card | Sign-up Reward | Milestone Benefit |

|---|---|---|

| HDFC Infinia | 10,000 bonus points | 20,000 bonus points on the anniversary |

| HDFC Diners Club | 5,000 bonus points | 10,000 bonus points on spending Rs. 5 lakhs |

Activation Process and Application Steps

To apply for an HDFC credit card, you must meet specific hdfc eligibility 2025 criteria. This includes age, income, and credit score requirements. After checking if you qualify, you can start the application process.

The application process requires you to submit some documents. These include identity proof, address proof, and income proof. You can look at the hdfc credit card offers 2025 to see what documents you need for your chosen card.

Here are the general steps to apply:

- Choose your desired HDFC credit card from the best hdfc credit cards for 2025 list.

- Check your eligibility and required documents.

- Fill out the online application form and submit the required documents.

- Wait for the verification and processing of your application.

After your application is approved, you’ll get your credit card. You can activate it by following the instructions given.

Conclusion: Choosing Your Ideal HDFC Credit Card

Exploring HDFC credit cards for 2025 shows, there’s a perfect match for everyone. Whether you travel, love shopping, or want to make the most of daily purchases, HDFC covers you.

Think about the best HDFC credit cards for 2025, their benefits, and reviews. This will help you pick the card with the most rewards and value. The right HDFC credit card can help you manage your money better and enjoy special perks.

Your perfect HDFC credit card will help you reach your financial goals. It could be earning air miles, enjoying travel, or saving on daily spending. Take time to look at the options, compare them, and pick the card to improve your financial life in 2025.