Reviews

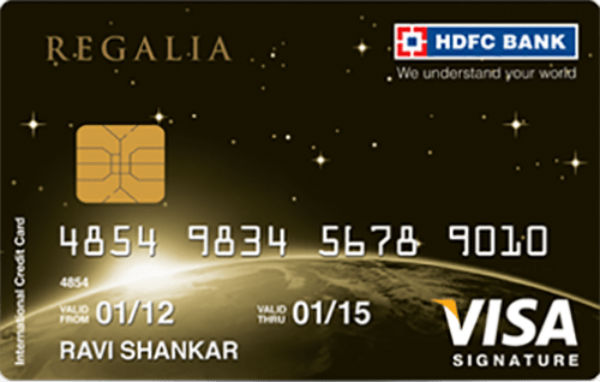

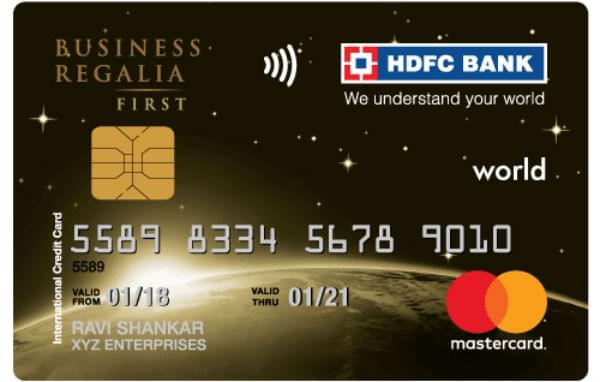

You can opt for the HDFC Regalia credit card to benefit from luxury services, receive exclusive services from corporations in your travels and everyday life, and much more. HDFC Regalia credit card is preferred by many people because of the advantages it offers in the categories of airport lounge access, Visa / MasterCard lounge access program, foreign currency markup fee, priority customer service, dining experience. In addition, the costs of the credit card are low and therefore the card is advantageous.

Benefits and Advantages HDFC Regalia Credit Card Brings

Rewards Points

In this HDFC Regalia credit card system, you can benefit from rewards points. 100 reward points are approximately 40 RS. You can spend any rewards points you collect at any time.

Earn Bonus Points

The bonus points offered for your retail expenses are much higher. You can earn 200 percent more bonuses than normal bonus rates. You will earn this rate for all your online retail expenses. This will save you money.

No Extra Payment for Lost Cards

If you lose your card, you will have the opportunity to renew your HDFC Regalia credit card without having to pay extra.

2 Rewards Points for every 150 Rs Spending

On your HDFC Regalia card, you will earn 2 rewards points for every 150 Rs you spend, regardless of the category. Once the rewards points have accumulated, you can use them to get free service.

Waive Annual Fee with Your Spending

If you do not want to pay the annual fee, you will have to spend Rs 50,000 per year. Customers who spend at this rate are considered privileged and do not pay the annual fee. In addition, if you spend Rs 10,000 within exactly 90 days of receiving your card, the annual fee you paid when receiving the card will be credited back to your account.

Prices & APR

- 1st Year – 0

- 2nd Year Onwards -2,500

- APR rate is determined as 23.88% annually