Reviews:

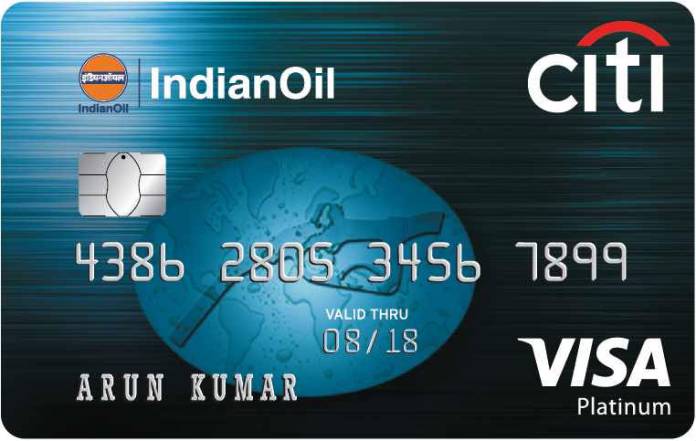

Indian Oil Citi credit card is a private credit card that offered to Indian citizens with the collaboration of Citi Bank and Indian Oil Company. If you are looking for a credit card that offers great advantages in your fuel expenses, then this card is the best card you can use in India. It offers many benefits and generous reward points (known as Turbo Points in this card) for those who use the card in fuel and supermarket expenses. Of course, you need to use your card in Indian Oil outlets, but it is also possible to use it like a regular credit card in your other shopping.

Advantages of Indian Oil Citi Card

Bonus Turbo Points in Indian Oil Company

The Indian Oil Citi credit cardholders can earn 4 Turbo points per 150 Rupees they spend in Indian Oil Company stations and supermarkets.

Bonus Turbo Points for Other Stores

Cardholders can also earn 1 turbo point for every 150 Rupees they spend in other stores.

Fuel Surcharge Waiver

In addition to turbo points, you can also benefit from a 1% fuel surcharge waiver when you purchase fuel in Indian Oil Company stations.

Annual Fee Waiver

If you spend at least 30,000 Rupees every month with your card, you will not have to pay an annual fee.

Disadvantages of Indian Oil Citi Card

Annual Fee

The Indian Oil Citi credit card has an annual fee. The cardholders need to pay 1000 Rupees per year to renew their cards.

No Lounges

You will not be able to benefit from domestic and international lounges in India.

Limited Promotions

This card is not a good choice for those who do not make fuel expenses and not recommended for those who do not own any type of vehicle.