Review:

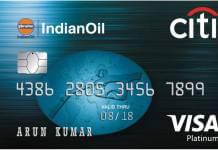

How would you like to meet a new generation credit card that uses Visa infrastructure? Your new generation credit card will give you discounts and bonus points in many areas, from restaurant spending to fuel spending. What’s more, thanks to the advanced mileage calculation system, you will have the opportunity to purchase free flight tickets on this credit card and benefit from high-level travel insurance. Let’s see features of IndianOil Citi Platinum Credit Card. For more information, please read the rest of the article.

Citi IndianOil Citi Platinum Credit Card Benefits

5% Cashback

IndianOil Citi Platinum Credit Card is extremely popular in terms of cashback advantages. If you wish to benefit from a five percent cashback bonus, we recommend that you spend all your expenses such as movie ticket purchases, telephone bill payment and all types of utility bill payments on this credit card.

Pay to Electronics with Installments

Electronic devices can sometimes be expensive enough to exceed your budget. In such cases, it may make sense to pay in installments. A new generation of CitiBank India Indian Oil credit cards with LCDs. In this way, you can pay in easy installments.

Still Earn Cashbacks for other expenses.

In all your other expenses, the cashback rate you will benefit is 0.5 percent.

Discounts at Restaurants

You can enjoy dinner at a discounted rate of 15 percent at approximately 2000 restaurants in India which are contracted.

Discounts at More than 100 Brands

Citi Bank, which deals with 100 different prestigious brands throughout India, offers discounts at different rates or allows you to earn bonus points when shopping from these brands. This saves you money.

Earn EMI

For those who want to take advantage of EMI, this credit card is the right choice. You can earn EMI with all your activities such as shopping, consumer electronics, mobile phone outlets, leading retail chains and e-retailers.

Prices and APR

If you have been using your IndianOil Citi Platinum Credit Card for a year or spend about Rs 30,000 per year on your credit card, no additional fee. But if not, the annual fee is 1000 Rs.